Extensive Infrastructure Asset Development, Underwriting & Operational Experience

A specialty technical and project finance advisory firm with 75 years of combined experience and a track record of proven success.

From renewable energy and power storage assets in North America to solar and energy infrastructure in Myanmar, we bring global experience to the table.

Who we are

Charles Costenbader

Mr. Costenbader has served as Chief Financial Officer and Chief Operating Officer in both public and private entities. Recently he worked 6 years in various roles as President, CFO, COO and finally as a Board Advisor to a company he helped establish that is commercializing a technology for chemical recycling of scrap plastic. He successfully positioned this company with a site he identified and acquired via a long term lease structure in Pennsylvania and FEED work was completed through to initial EPC Agreement negotiations. He has worked in Shanghai, China as Chief Operating Officer of Synthesis Energy Systems, Inc., a publicly traded entity listed on NASDAQ. Previously his position was Chief Financial Officer in this coal to syngas to chemicals company. He has 35 years of physical asset operations and commodity risk management experience in the power generation, refining, natural gas storage, biofuels, demand response, energy storage and renewable energy sectors, including 10 years in the Structured Finance Group of GE Capital and 6 years in the energy commodities division at Macquarie Bank. He has served as a Board Director for several energy companies in the United States and China. He holds a B.S. degree in Mechanical Engineering, an M.B.A. in finance and operations management from Columbia University, and a B.A. degree in German Language & Literature studies, Oregon State University. He is a licensed Professional Engineer and has published a continuing education course for Professional Engineering License candidates titled “Design and Commissioning of Power Plants”. He is also co-author of “Scale up Practices for Today’s Breakthrough Technologies” written for the American Institute of Chemical Engineers. On July 10, 2010 the Four Chaplains Memorial Foundation granted him the Legion of Honor Award for his ongoing 36 years of voluntary service as a Eucharistic Minister in the US Military working with disabled veterans. He currently serves as 7th term re-elected Board Chairperson for www.montgomerycountycrimestoppers.org , a 501C3 charity supporting local law enforcement in Texas.

Mike Tzougrakis

Mr. Tzougrakis has more than 40 years experience in the Energy and Industrial Project Finance business with a comprehensive understanding of all aspects of successful investing including Development, Design, Proposal, Bid, Manufacturing, Scheduling, Procurement, Turn-Key Construction, Commissioning and facility start up. Mr. Tzougrakis has an electrical engineering degree and worked for General Electric and the GE Capital Corporation from 1968 to 2002 where he later served as Managing Director responsible for managing one of the largest Energy and Industrial project portfolios in the structured finance sector. His career at General Electric began in the field usually under significant time pressure with hands-on startup commissioning and troubleshooting work in power plants around the world. He was directly responsible for properly managing and minimizing distressed assets while maximizing income from portfolio asset sales for GE Financial Service’s Portfolio that included the United States and overseas energy and industrial portfolio. In addition, he oversaw the underwriting of an average of 30 to 50 new energy and industrial project proposals each year in renewable energy, wood, wind, hydro, geothermal, solar and municipal waste, as well as industrial power and process facilities in the paper, steel, beverage and mining industries. He was a member of the Investment Committee responsible for the technical underwriting of all deals. After retiring from GE Capital Mike also served as a consultant to the U.S. Department of Energy Loan Guarantee Division.

Areas of Expertise

Non-Power Generation

-Refineries

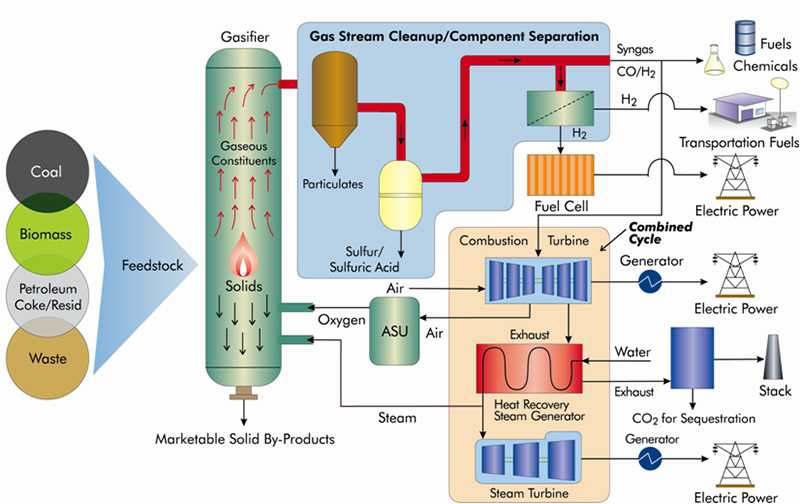

-Gasification

-Coal to Chemicals

-Methanol from Syngas

-Waste Coal Remediation

-Midstream Assets:

Gathering Systems

Pipelines

Salt Dome Storage

Depleted Reservoir Storage

Aquifer Storage

-Mechanical and Chemical Recycling of Scrap Plastic

Power Generation

-Natural Gas

-Coal

-Hydroelectric

-Wind

-Solar

-Waste Coal

-Biomass Power Generation

-Waste to Energy

Specific Technical Underwriting

-Review drawings and design specifications

-Reconcile cash flow assumptions with supporting contracts

-Review schedule cost and performance assumptions

-Represent owner’s interests during construction

-Review and approve Change orders

-Review and approve Commission Testing protocol

Power Storage

-Thermal

-Battery

-Compressed Air Energy

-Pumped Storage

-Hydroelectric

Midstream Assets

-Gathering Systems

-Pipelines

-Salt Dome Storage

-Depleted Reservoir

-Storage

-Acquifer Storage

Recent Engagements

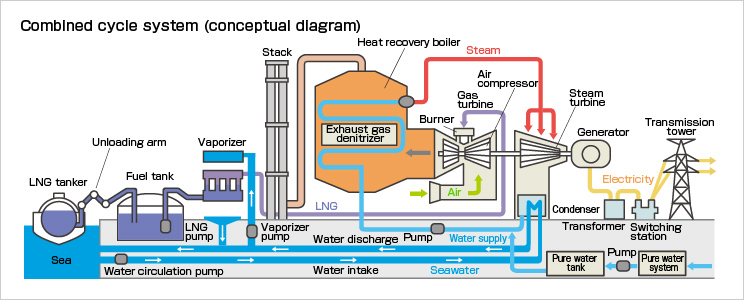

– Limited Partner in 1,200 Megawatt North Bergen Liberty Energy Center with service into ConEdison territory in Manhattan.

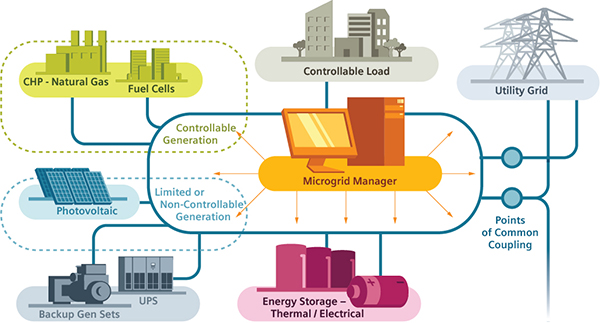

– Managing Member & Founder in Microgrid PR, LLC to focus on microgrid solutions in the Caribbean basin to combine customer services, billings, wind generation, solar generation and battery storage with diesel fired backup power.

– Serving as Chief Operating Officer for Encina Development Group, LLC to develop a scrap plastic feedstock to aromatic chemicals production business.

– Consulting Advisor on technical, contractual, financial and structural topics related to private equity investments in renewable energy and power storage assets in North America.

– Minority Equity owner in Quasar Resources, Inc.

– Screening Committee Member & Energy Technology Advisor – Houston Technology Center

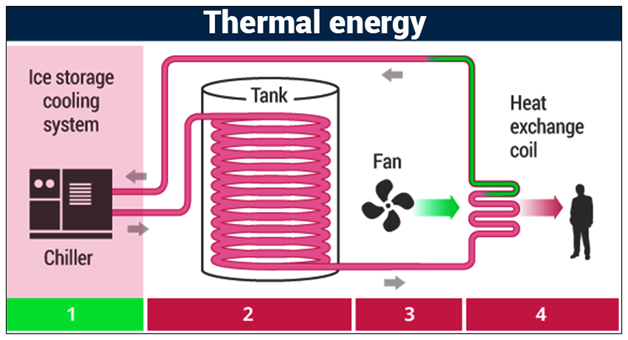

– Interim CFO in 2016, Ice Energy Holdings, Inc. providing peak demand mitigation.

Recent Engagements

Assisted development finance effort for the 1,200 MW North Bergen power asset with transmission access to NY city, currently a limited partner in the development company

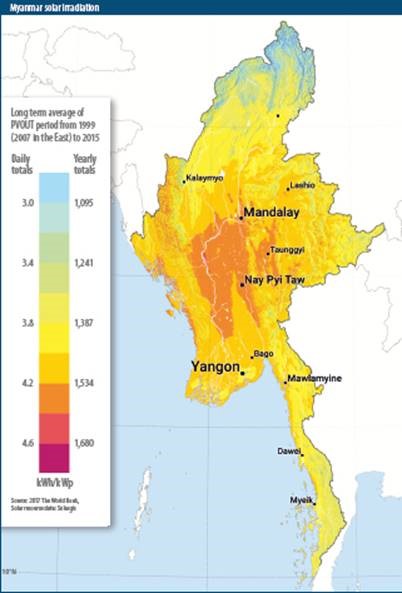

Sourced development funding for solar asset developments in Myanmar, currently a limited partner in the development company

Served as Chief Financial Officer under contract for a thermal energy storage firm

Contracted financial services and fund-raising officer for a coal to chemicals firm

Founded PR Microgrid, LLC to bid into Microgrid RFP’s in Puerto Rico

Completed due-diligence assignments for the following proposed investments:

a. 20 MW battery storage project

b. On-going several MW’s Northeast commercial rooftop solar projects

c. Biogas to pipeline quality gas

d. Biomass/Railroad tie power generating asset

e. Residential scale battery storage integrated with rooftop solar

f. Geothermal development strategy

g. Hydroelectric project with extensive tunnel entrance to the penstock

-CoView Capital, Inc – supporting this investment advisory firm regarding various energy and new technology initiatives, including a recent Hydrogen Development Business

-Rouse Energy Enterprises, LLC – solid fuel supplement for industrial applications

-GoldenSet Capital Partners, LLC – solar, wind, battery storage and renewable natural gas projects – underwriting and asset optimization

-Galaxy FCT SDN – hydrogen production, delivery and retail consumption – corporate structuring

-Prepared the Business Plan and Financial Modelling for a large Houston based Natural Gas hedge fund to target various unique peaking power plant opportunities in North America.

Fee Structure

Fee Structure is flexible and can be one of three structures or a combination thereof:

1. Fixed monthly retainer

2. Hourly Billing

3. For existing operating assets, we can provide an engineering, financial and operational audit at no cost in exchange for shared savings identified.